AI’s Verdict: Trend Following Trumps Macro in the Investment Arena

I often receive emails highlighting macroeconomic data that supposedly contradicts or challenges the signals provided by price action—or trend-following—in markets like stocks, crypto, bonds, etc. These messages can give the impression that trend-following alone isn’t enough to keep us on the right side of the market, or worse, that the latest piece of fundamental information might derail the message given by price action.

While I do monitor certain fundamental variables that could hint at a potential trend shift, I want to stress a core principle: price action always comes first. If something is trending upward, it’s usually better to follow the trend rather than overanalyze or second-guess.

If fundamentals seem to clash with an uptrend, it’s a signal to manage risk more carefully—tightening stops or selling fully instead of partially if a breakdown occurs, as I did in our July 1st Letter to Subscribers. However, avoiding buying or selling prematurely just because of a concerning macro factor can often lead to missed opportunities. Let the price guide your decisions.

Undoubtedly, intelligent authors pen these dense macro reports, but their track records often fall short of expectations. These fundamental reports can be so convincing that I would frequently take the bait if I weren’t a staunch trend follower.

While I’ve always known that trend-following strategies have historically outperformed those based on fundamental analysis—no matter how compelling macro predictions may seem—I wanted to get an objective perspective. To do so, I turned to AI Perplexity and asked the following question:

“There are several approaches to investing. One is ‘macro,’ which focuses on economic variables like unemployment, interest rates, GDP, etc. Macro investors try to forecast future market prices and profit from them by analyzing economic variables. On the other hand, there are trend followers who only focus on price action and disregard the economic data. Please check existing funds and hedge funds based on these two approaches and tell me which has historically had better performance and less drawdown.”

The response I received was enlightening and supported my inclination towards trend following. Here’s a summary of the key points:

[Start of AI quote]

Both global macro and trend following strategies have played significant roles in the hedge fund industry, each with its own strengths and historical performance characteristics. Global macro hedge funds analyze worldwide macroeconomic trends to identify investment opportunities across global markets, employing directional, relative value, and opportunistic trades. Notable global macro funds include AQR, Bridgewater, Citadel, and D.E. Shaw, among others. Trend following strategies, often categorized under Managed Futures or CTAs (Commodity Trading Advisors), focus on price movements rather than fundamental economic data. These strategies aim to capture medium-term price trends across various asset classes. Prominent trend following hedge funds include Winton Trend Fund, AQR, Man AHL, and Systematica. When comparing the two approaches, the AI’s analysis revealed several key advantages of trend following strategies:

- Long-term performance: Trend following strategies have shown to perform as well as equities in the long term, but with lower risk and smaller drawdowns. The Eurekahedge Trend Following Index demonstrates positive annual returns in most years since 2000, with particularly strong performances during market crises.

- Drawdown profile: Trend following strategies generally exhibit a more favorable drawdown profile compared to macro funds and equity markets. Maximum drawdowns for trend following strategies tend to be around 1.5 times their annualized volatility, compared to almost 3.5 times for equities.

- Crisis performance: Trend following strategies have shown exceptional performance during market crises. For example, during the 2008 financial crisis, when the S&P 500 experienced a 51% drawdown, trend following strategies gained 16.74%.

- Consistent profitability: A study examining trend following performance from 1880 to 2016 found that the strategy has been consistently profitable throughout this 137-year period.

While both strategies offer diversification benefits to traditional portfolios, trend following has shown particularly strong performance during equity market crises. A 50/50 combination of trend following and equity markets has been shown to increase the Sharpe ratio for equity markets by 66% and reduce the maximum drawdown from 51% to 22%. Based on this analysis, trend following strategies appear to have better average performance and less drawdown compared to macro funds. They have demonstrated more consistent positive returns over long periods, shallower drawdowns, better performance during market crises, and strong recent performance. “

[end of AI quote]

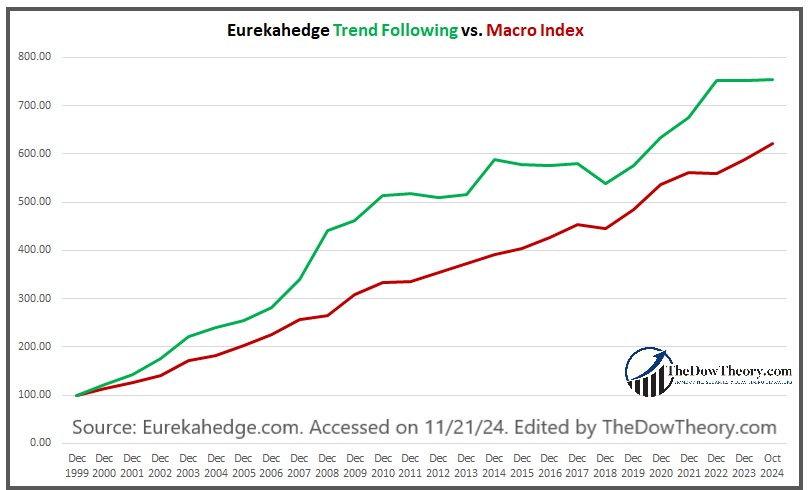

I downloaded and plotted the Eurekahege Trend Following Index performance data against the Macro Index from December 1999 to October 2024. Both Indexes are based on an equally weighted index of many funds that invest in stocks, futures, commodities, interest rates, etc.

The chart shows that trend-following beats macro:

The trend-following index delivers an average annual return of 8.83%, outperforming the macro index’s 7.71%. Notably, our trend-following indicator, The Dow Theory for the 21st Century (DT21C) has performed even better than both, as demonstrated HERE. This is particularly impressive given that our model performance was obtained by relying solely on the Dow Industrials and operates only on long positions. In contrast, the trend-following and macro indices utilize long/short strategies across a wide range of markets. The DT21C’s outperformance highlights the precision and effectiveness of our highly refined trend-following methodology. .

While this is not an indictment against macro, the takeaway is clear: An information overload need not necessarily translate into more performance. I want to spend my time becoming a better trend follower and, notably, creating good trend-following portfolios that are better than the sum of their parts rather than breaking my head trying to figure out which economic variable will influence the stock market’s next move.

This information reinforces my commitment to trend following as a primary investment strategy. While macro analysis can provide valuable insights, the historical evidence suggests that following price action and trends has been more reliable and profitable. As always, it’s important to remember that past performance does not guarantee future results, and the effectiveness of these strategies can vary depending on market conditions and implementation. However, the data strongly supports the notion that price action indeed trumps everything when it comes to investing.

Sincerely,

Manuel Blay

Editor of thedowtheory.com